how much is inheritance tax in georgia

It is not paid by the. Your average tax rate is 1198 and your marginal tax rate is 22.

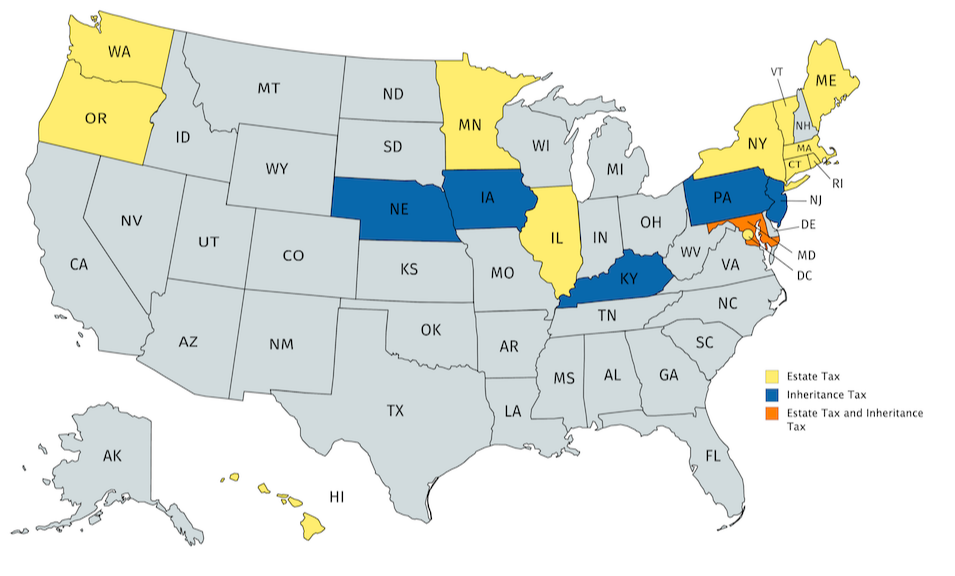

State Estate Tax Rates State Inheritance Tax Rates Tax Foundation

The federal estate tax generally applies to assets over 1206 million in 2022 and 1292 million in 2023.

. Inflation has continued to surge near 40-year highs over the past few months. Georgia has no inheritance tax but some people refer to estate tax as inheritance tax. Understanding Georgia inheritance tax laws and rules can be overwhelming.

No estate tax or. Whether youre an executor newly in charge of handling a complex estate left by a business owner or youre a. Georgia has no inheritance tax but some people refer to estate tax as inheritance tax.

There is no federal inheritance tax but there is a federal estate tax. The effective rate state-wide comes to 0957 which costs the average Georgian 155130 a year based on the median home value in the state of 157800. No estate tax or inheritance tax.

The top estate tax rate is 16 percent exemption threshold. However it does not liberate Georgia residents from the Federal Estate Tax if the inheritance exceeds the exemption bar of 1206. The real estate transfer.

Ad Register and Subscribe Now to work on Amended Indiv Income Tax more fillable forms. An estate takes into account a households total wealth including property. If the value of what the heir will receive is at or.

Once the tax has been paid the clerk of the superior court or their deputy will attach to the deed instrument or other writing a certification that the tax has been paid. Edit Sign and Save GA T-20A 600 Form. No estate tax or inheritance tax.

Georgians are only accountable for federally-mandated estate taxes. It hit its 40-year high of 92 in June and has since. Estate taxes are only mandated in a handful of states and thankfully there is no Georgia inheritance tax.

1 day agoWhat do election results mean for interest rates. It is not paid by the. In Georgia most people do not pay any taxes when they die or inherit money or property from someone who has passed on.

State inheritance tax rates range from 1 up to 16. This means inheritance tax of 40 per cent is only charged on estates worth more than this amount. The credit used to determine the Maryland.

Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning. The tax is paid by the estate before any assets are distributed to heirs. As of 2014 Georgia does not have an estate tax either.

For 2020 the estate tax exemption is set at 1158 million for individuals and 2316 million for married couples filing jointly. The Maryland estate tax is based on the maximum credit for state death taxes allowable under 2011 of the Internal Revenue Code. Ad Web-based PDF Form Filler.

How much inheritance is tax free in Georgia. If you make 70000 a year living in the region of Georgia USA you will be taxed 11993. PdfFiller allows users to Edit Sign Fill Share all type of documents online.

This marginal tax rate means that. Download or Email T-20A More Fillable Forms Register and Subscribe Now. 20 hours agoChancellor Jeremy Hunt plots to cut capital gains tax allowance to 6000 Daily Mail Online.

Charitable and nonprofit organizations dont pay a tax if the amount is less than 500 but 10. Distant family and unrelated heirs pay between 10 and 15 percent of the value of the inheritance. 100s of Top Rated Local Professionals Waiting to Help You Today.

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. Jeremy Hunt wants to increase revenues from the current 10billion per year. The tax is paid by the estate before any assets are distributed to heirs.

Free Georgia General Warranty Deed Form Pdf Word Eforms

General Sales Taxes And Gross Receipts Taxes Urban Institute

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2020 Complete Guide To Retirement Plan Rollovers Momentum Wealth

Gov Charlie Baker Optimistic About Nearly 700 Million In Tax Break Proposals Including Changes To Massachusetts Estate Tax Masslive Com

General Sales Taxes And Gross Receipts Taxes Urban Institute

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Taxes Georgia Department Of Revenue

Transfer On Death Tax Implications Findlaw

2021 State Corporate Tax Rates And Brackets Tax Foundation

Nebraska Probate Form 500 Inheritance Tax Fill And Sign Printable Template Online

Georgia Estate Tax Everything You Need To Know Smartasset

Georgia Income Tax Calculator Smartasset

Inheritance Tax Here S Who Pays And In Which States Bankrate

Creating Racially And Economically Equitable Tax Policy In The South Itep

Estate Planning Attorneys In Atlanta Ga Best Estate Planning Lawyers In Atlanta

Dekalb County Ga Property Tax Calculator Smartasset

State Estate And Inheritance Tax Treatment Of 529 Plans

Georgia Tax Rates Rankings Georgia State Taxes Tax Foundation